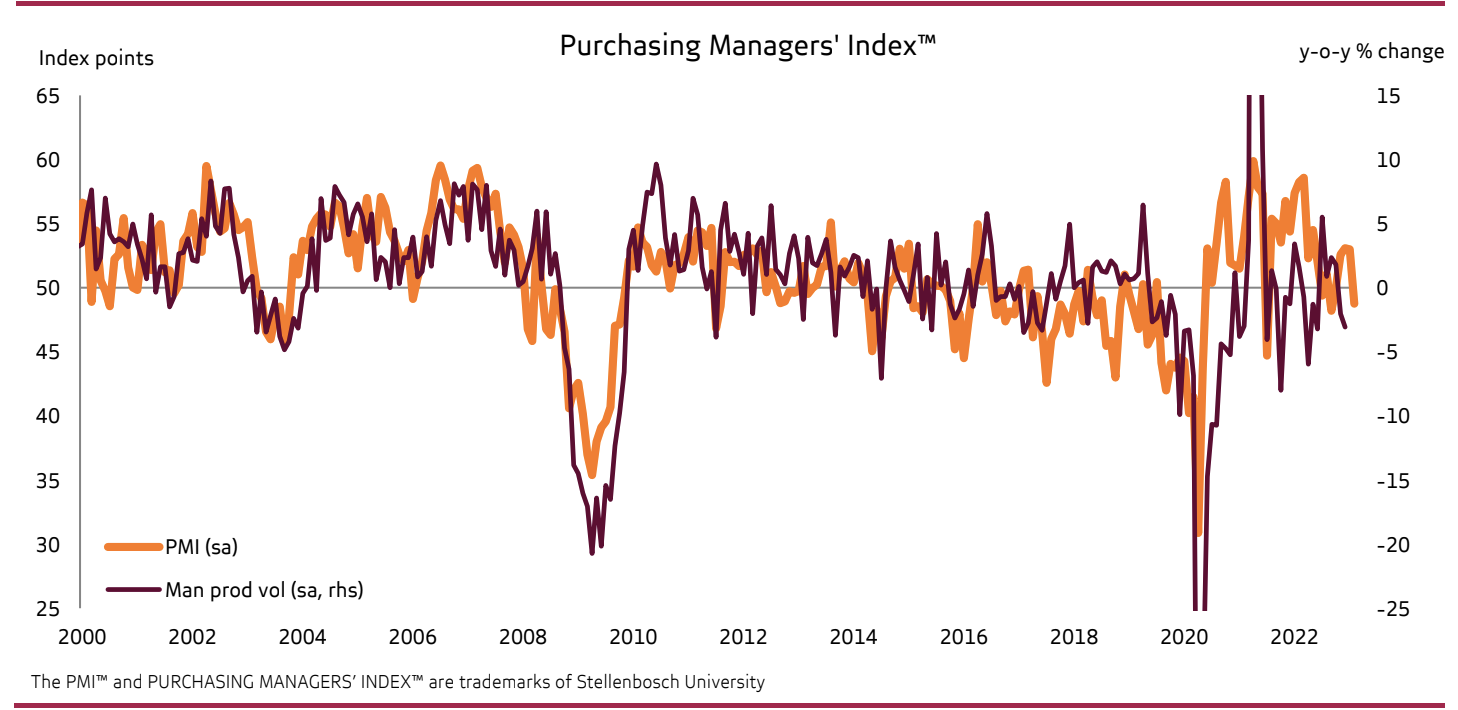

After surprising on the upside in January, the seasonally adjusted Absa Purchasing Managers’ Index (PMI)

declined to 48.8 index points in February from 53 in January. This was the first time since September 2022 that

the headline index fell below the neutral 50-point mark, pointing to a marked deterioration in business

conditions in the factory sector. Indeed, the business activity and new sales orders indices were both in

contractionary terrain, with demand dipping for a second consecutive month. The February survey period

included an unprecedented seven consecutive days of stage 6 load-shedding, which was likely top of mind for

many respondents. To be sure, load-shedding once again featured frequently in the commentary where

respondents explained why activity declined relative to the previous month. A glimmer of good news was that

export sales rose to the best level in a year, implying that producers supplying solely to the domestic market

likely had a tough month. In line with a weaker output picture, the employment and inventories indices also

came in below the neutral 50-point mark.

There was more bad news in the form of a sharp decline in the index measuring expected business conditions

in six months’ time. The index fell to 46.8 points in February, which is the lowest level since May 2020. This

means that respondents have not been this downbeat about future conditions since the country was slowly

moving out of the strictest phase of the COVID-lockdown.

Furthermore, the purchasing price index surged higher for a second month to reach the highest level since

September 2022. The survey took place while the rand was very weak (against the US dollar), largely trading

above R18/$. This would have filtered through to the costs of especially imported raw materials and

intermediate goods. The surge in the PMI’s price index suggests that we may see a renewed acceleration in

factory-gate prices. That said, the index remains well below the peak reached in the first months of 2022.